Dr. KOBAYASHI Teruyoshi, an associate professor at the Graduate School of Economics, Kobe University and Dr. Charles Brummitt of Columbia University have proposed a new model to predict a financial crisis (a chain of bankruptcies) using a multiplex network model in which debts with different priorities are mutually held by banks. Their results were published on June 24 in the “Highlight (Synopsis)” section of the online edition of Physics, a journal of the American Physical Society.

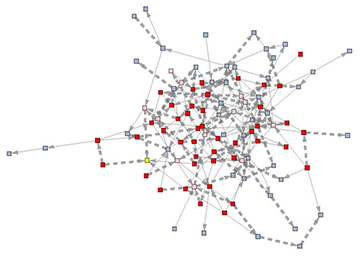

Blue: healthy banks.

Yellow: the first bank that goes bankrupt. Red: banks that cannot repay all of their debts of all seniority levels.

Pale red: banks that cannot repay their junior debts but can repay senior debts.

Dashed arrows: junior debt contracts.

Solid arrows: senior debt contracts.

Although much research has been conducted on the risk of financial markets since the bankruptcy of Lehman Brothers in 2008, which started the recent financial distress, most have adopted the “information-cascade model”, a simple model of information transmission through a network. However, a risk transmission model via more complicated structures is necessary because a real financial market has a multitude of overlapping transactions.

When a financial institution goes bankrupt, creditors with high-priority bonds (called senior bonds) can be fully repaid from the institution’s remaining assets, while lower-priority creditors (those with junior bonds) cannot. In the traditional financial crisis model, it has been unclear how the difference in non-repayment risk due to debt priorities affects systemic risk.

Dr. KOBAYASHI and his team used a “multiplex network” to express the differences in the priority of debt repayments. For example, they described the transaction relations of junior bonds in one layer of a network and those of senior bonds in the second layer. By generalizing the standard cascade model to an arbitrary number of layers, his team clarified the effect caused by the difference in non-repayment risk of debts of different priorities. In addition, they derived a condition for which debt structures of the entire market will cause a financial crisis, and verified the accuracy of the condition by numerical simulations. Consequently, they confirmed that a necessary condition for minimizing systemic risk is that at least 50% of debts in the entire market should exist as senior debts.

Currently the Basel Committee founded in the BIS (Bank for International Settlements) leads the global financial regulation and each country establishes its own rules based on it. However, the existing financial restrictions do not take into consideration that systemic risk varies largely according to the priority of debts mutually held by various financial institutions. Based on this research result, Dr. KOBAYASHI stresses that new regulations should be reexamined from the viewpoint of debt structures.

Journal information

- Title

- “Cascades in multiplex financial networks with debts of different seniority”

- DOI

- 10.1103/PhysRevE.91.062813

- Authros

- Charles D. Brummitt and Teruyoshi Kobayashi

- Journal

- Physics